Finserve Africa Limited

| |

| Equitel | |

| Private Subsidiary | |

| Industry | Telecommunications |

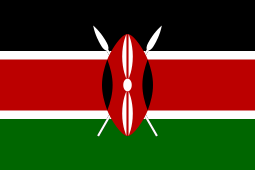

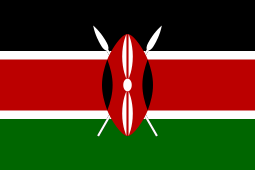

| Headquarters | Nairobi, Kenya |

Area served | Kenya |

| Products | Mobile money & telephony |

| Parent | Equity Group Holdings Limited |

| Website | Homepage |

Finserve Africa Limited (trading as Equitel)[1] is a mobile virtual network operator (MVNO) in the Kenya. It is a wholly owned subsidiary of Equity Group Holdings Limited and is using the Airtel Kenya[2] network as its carrier.

Overview

The Equitel brand was hailed by Equity Group as the 'next big thing' i.e. Equity 3.0. The move was to give Equity Bank the opportunity to continue its mission of furthering financial inclusion and innovative service offerings for all Kenyans by presenting their financial services offering on to a single platform which will make banking services more accessible, flexible convenient and more affordable. Airtel Kenya on their part stated that the partnership would increase their revenue by up to 10%.[3]

The brand made Equity Bank the first financial institution in Africa to offer a full banking suite through an MVNO.

History

Equity Bank, through its subsidiary Finserve Africa Limited, received its MVNO Licence on 11 April 2014, along with Tangaza Money and Zioncell Kenya. All which would run on Airtel Kenya's network, a move that was opposed by the Consumer Federation of Kenya, Safaricom and Telkom Kenya[4]

For the Bank, the move was aimed at lowering their transaction costs by up to 47% as well as an added revenue stream by providing money transfer service and other telco services to their 8.7 million customers.[5]

Due to the requirement to have a SIM card to access the service, users would therefore need an additional mobile phone or Dual SIM phone. Equity Bank overcame this challenge by adopting the use of 0.1 millimetres thick ultra-slim SIM cards from Taisys Solutions, using technology originally developed in China.[6] The ultra-slim SIM cards are placed at the back of normal SIM cards therefore tackling this challenge effectively.[7] This ultra-slim SIM cards would also come with Near Field Communication (NFC) capability that enables them to be swiped on the point of sale devices or ATM[8] thus converting a mobile phone into a credit or debit card.

Market leader Safaricom wrote to the Communications Authority of Kenya (CAK) challenging the use of ultra-slim SIM cards stating that they could expose their subscribers to intercepted communication and financial fraud on M-Pesa service.[9] Despite this, Finserve Africa were granted a one-year trial period through the 0763xxxxxx prefix.[10]

On 22 September 2014, Safaricom stated that it would review its legal commitments to M-Pesa customers who opt to use the Equitel overlay SIM cards.[11] In addition, the CCK required Finserve Africa to make a written undertaking to compensate mobile phone subscribers for any losses they may incur during the one-year trial of its thin SIM, putting to test the company’s assertion that the technology is safe.

On 14 October 2014, Equity Bank Kenya started issuing ordinary SIM cards for telecommunication and mobile banking services to its 8.7 million customers across the country.[1]

Other locations

Equity Bank Group plans to roll out their mobile virtual network in Uganda, Tanzania and Rwanda through their partnership with Airtel Africa.

Equity Group Holdings Limited

Equity Group Holdings Limited is a large financial services group in East Africa. As of March 2014, The group had an asset base valued at over US$3.45 billion (KES:295 billion), with a total customer base in excess of 8.7 million, in the region the group serves.[12] The companies that comprise the Equity Bank Group include the following:[13]

- Equity Bank Kenya Limited – Nairobi, Kenya

- Equity Bank Rwanda Limited – Kigali, Rwanda

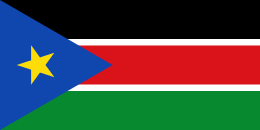

- Equity Bank South Sudan Limited – Juba, South Sudan

- Equity Bank Tanzania Limited – Dar es Salaam, Tanzania

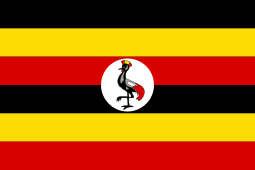

- Equity Bank Uganda Limited – Kampala, Uganda

- ProCredit Bank Congo SARL – Kinshasa, Democratic Republic of the Congo

- Equity Consulting Group Limited – Nairobi, Kenya

- Equity Insurance Agency Limited – Nairobi, Kenya

- Equity Nominees Limited – Nairobi, Kenya

- Equity Investment Services Limited – Nairobi, Kenya

- Finserve Africa Limited – Nairobi, Kenya

- Equity Group Foundation – Nairobi, Kenya

Shares of the stock of Equity Group Holdings Limited, the parent company of Finserve Africa Limited, are listed on the Nairobi Stock Exchange (NSE), under the symbol EQTY. The Group's stock is also cross-listed on the Uganda Securities Exchange (USE), under the symbol EBL.

See also

- Equity Bank Group

- Equity Bank (Kenya)

- Equity Bank (Rwanda)

- Equity Bank (South Sudan)

- Equity Bank (Tanzania)

- Equity Bank (Uganda)

- MPesa

References

- 1 2 "Equity issuing free Equitel SIM cards to customers". Business Daily. Nation Media Group. 14 October 2014. Retrieved 15 October 2014.

- ↑ Equity Bank to launch MVNO services in July

- ↑ Equity Bank Launches MVNO Strategy

- ↑ Equity gets special window to enter mobile telecoms market

- ↑ Equity seeks to halve transaction costs with mobile licence

- ↑ Skin SIM Technology: A Serious Challenge for Safaricom

- ↑ Equity Bank goes for special SIM cards for its mobile money service

- ↑ Equity to enable phone use in ATM withdrawal

- ↑ SIM card makers to offer expert advice on Equity case

- ↑ Equity Bank Group - Financial Results Press Release, 30 July 2014

- ↑ Safaricom sounds warning to users of Equity’s thin SIM

- ↑ Kangethe, Kennedy (17 April 2014). "Equity Group In 20 Percent Profit Rise to Sh3.8 Billion". Capital FM Online (Nairobi) via AllAfrica.com. Retrieved 17 April 2014.

- ↑ Members Of Equity Bank Group